avalara tax codes mapping

Tax code mapping group. Tax code mapping group.

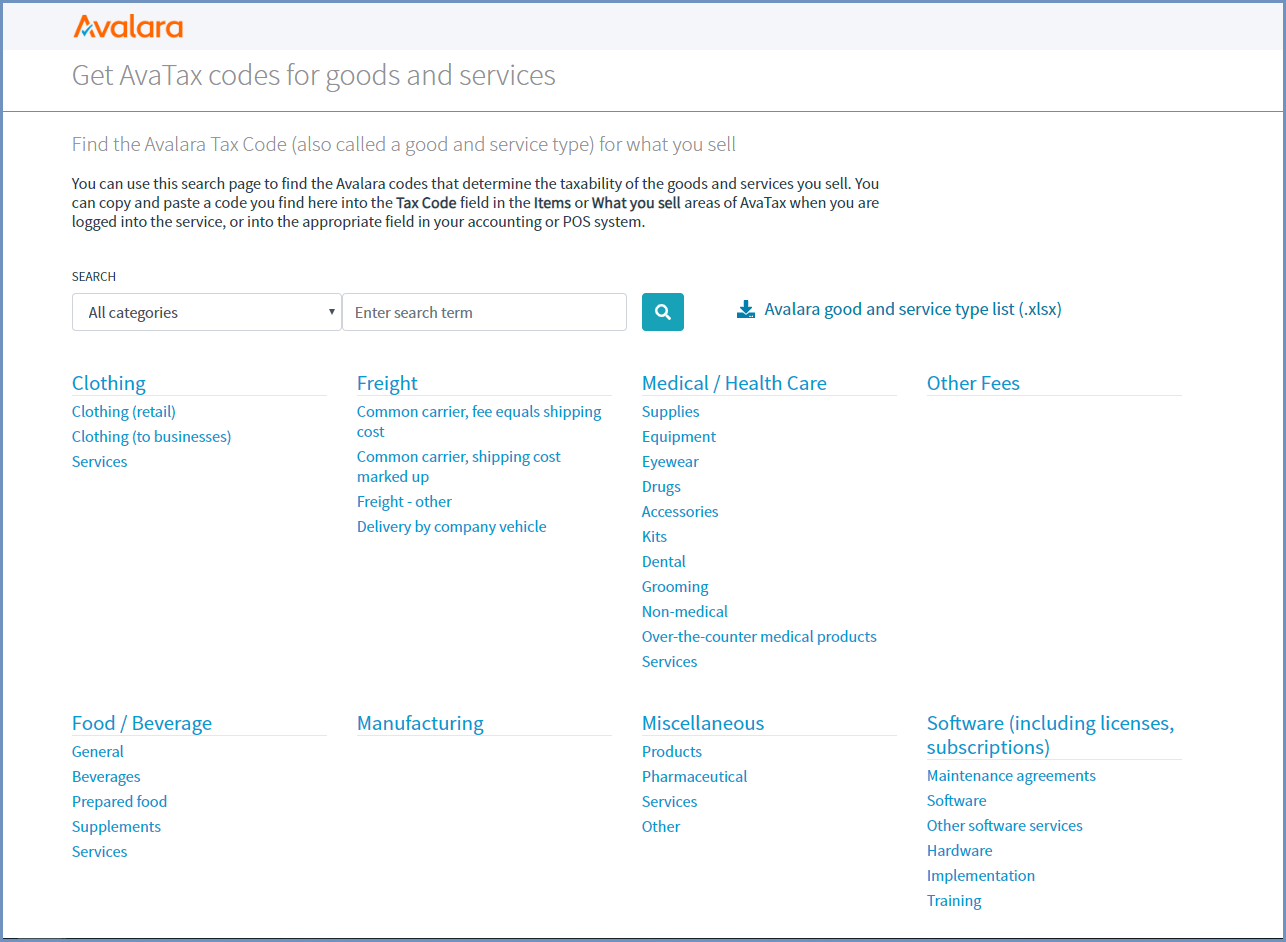

Access the tax research you need in just a few easy steps.

. 159 rows AvaTax for Communications supports tax calculation for a number of countries states territories and provinces. Add up to 20 tax codes. Steps In AvaTax go to Settings What You Sell.

Verify Avalara calculated Tax Amount is. If you have items that use P0000000 or U0000000 map them to an Avalara tax code so theyre taxed at the most up-to-date rate. HOW DOES AVALARA TAX RESEARCH WORK.

Tax rates are provided by Avalara and updated monthly. AvaTax 10 min. Marketplace facilitator tax laws.

You can copy and paste from an Excel. Returns preparation filing and remittance. STEP 01 Sign up for your Avalara Tax Research account to access your online.

P0000000 is used as a stand-in tax code. Enter the Avalara AvaTax Tax Code in the field and click Save. Mapping Resources - Avalara Help Center Search the library of documentation for tax engine information including related products reporting utilities and file formats.

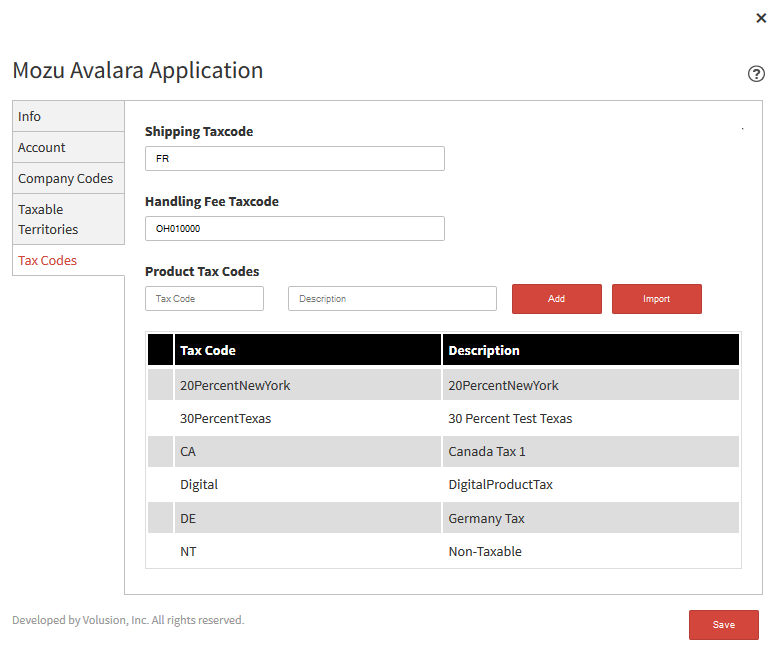

Sales and use tax determination and exemption certificate management. These tax codes are taxed at the full rate. Tax Codes Items or What you sell.

P0000000 is used as a stand-in tax code for. Server audit clarity and installation. If you must map more than 100000 SKU codes to.

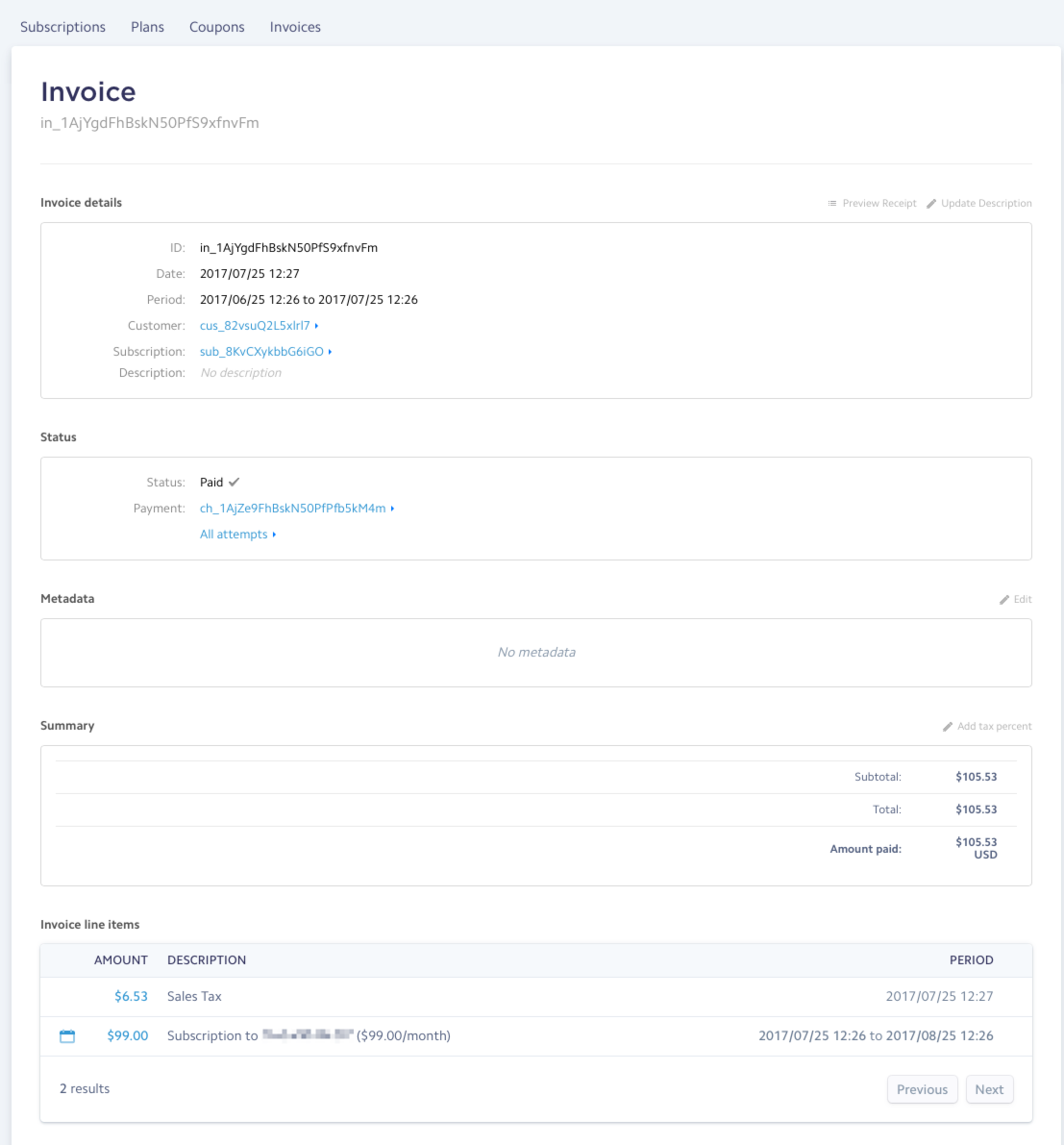

Tax rates are provided by Avalara and updated monthly. Verify Avalara calculated Tax Amount is used in transaction. TaxCode the Avalara Product Tax code for the variant Its important to note that there is a maximum of 100000 items per import.

Avalara Self-Serve Tariff Code Classification is an intuitive AI-enabled tool that allows you to easily determine codes and requires no prior experience in HS classification. On the What You Sell page select the checkboxes next to the items you want to map to the same Avalara tax code and then click. To begin this process go to Integrations Taxes Avalara Tax Code Mapping.

Click Add Mapping in the product row. To ensure accurate tax calculation Avalara. 53 - Mapping Items to TaxCodes Some customers prefer to go further - to actually create a product catalog and use AvaTaxs ItemCode feature to classify their products and link them.

AvaTax tax code mapping - Item codeSKU. Avalara Connector for NetSuite 7 min. AvaTax tax code mapping - Item codeSKU.

Connect with Avalara for more accurate rates to help you do tax compliance right Call 877-286-2149 Schedule a call Chat Chat with a specialist Customer support chat. Avalara for Small Business 6 min. Look up 2022 sales tax rates for Seattle Washington and surrounding areas.

You can either start typing and select from the list of available tax codes or paste the appropriate tax code. P0000000 is a generic code that is used when you have items that arent mapped to an Avalara tax code. Tax Codes Search Avalara.

The most common place to map an item to a tax code is the place where you maintain your master inventory list which is typically in your business application.

Enablement Steps For Advanced Taxation Nimble Ams Help

Stripe Connector For Netsuite Handling Taxes With Stripe Netsuite

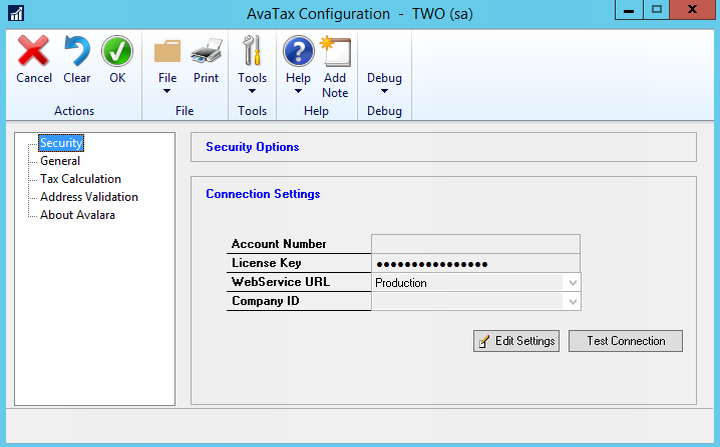

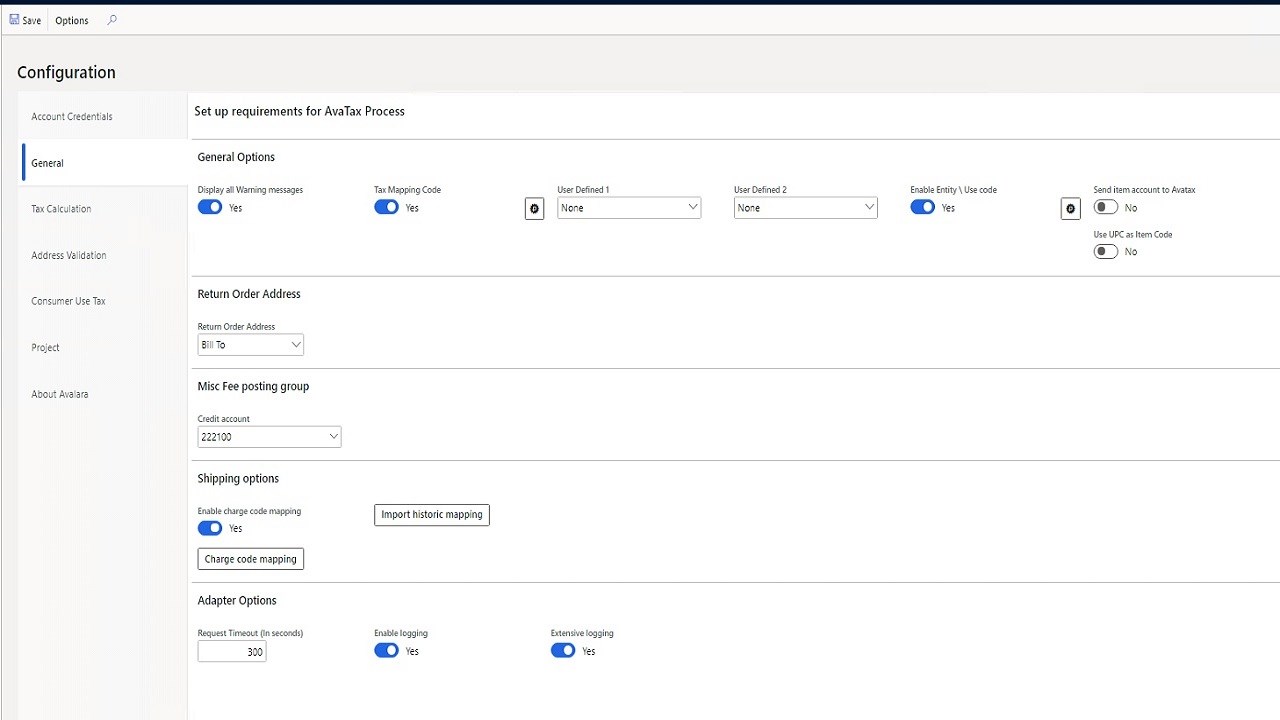

Avalara Configuration In Sap Business Bydesign Sap Blogs

Known Issue Multi Level Tax Code Mapping When Avalara Enabled Wise Sync For Connectwise Manage

Find The Right App Microsoft Appsource

Sales Tax Detailed Technical Implementation Givesignup Blog

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

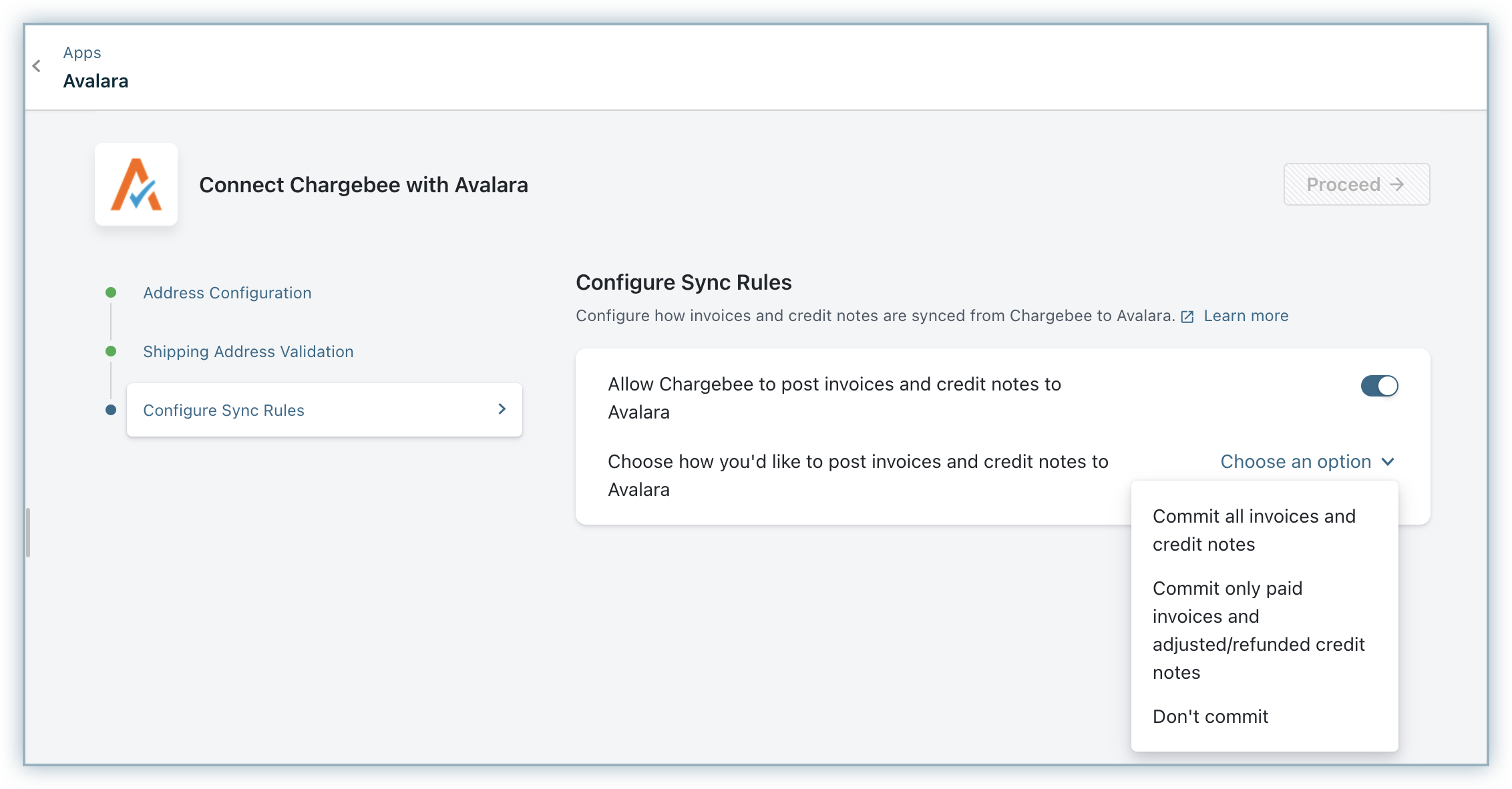

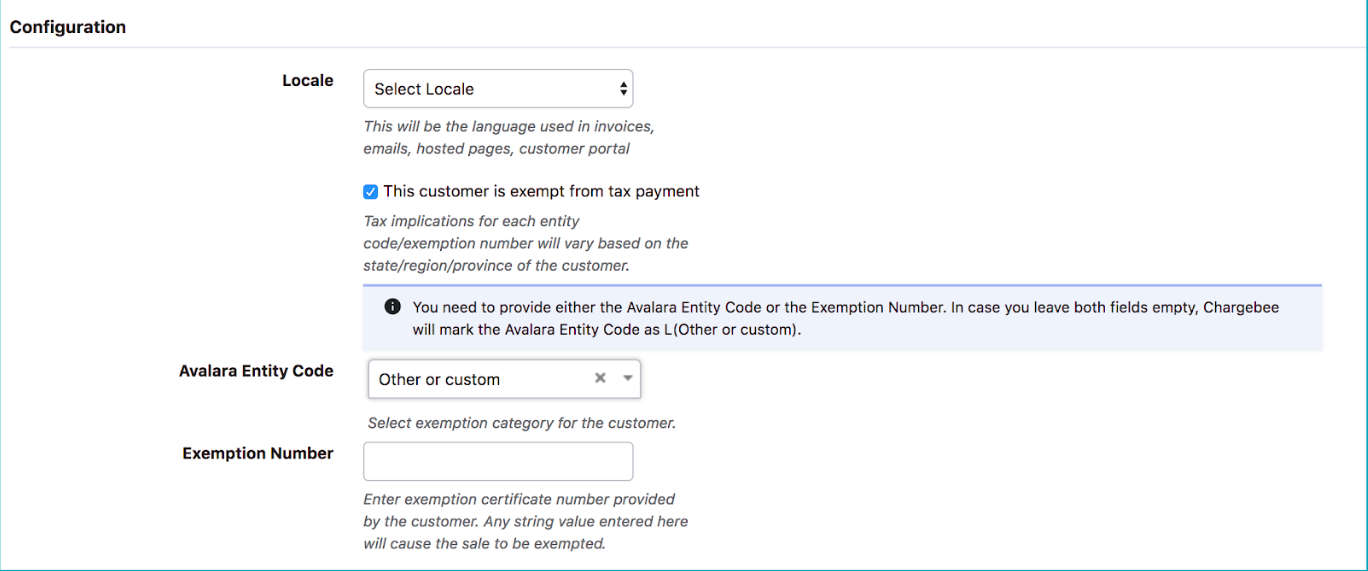

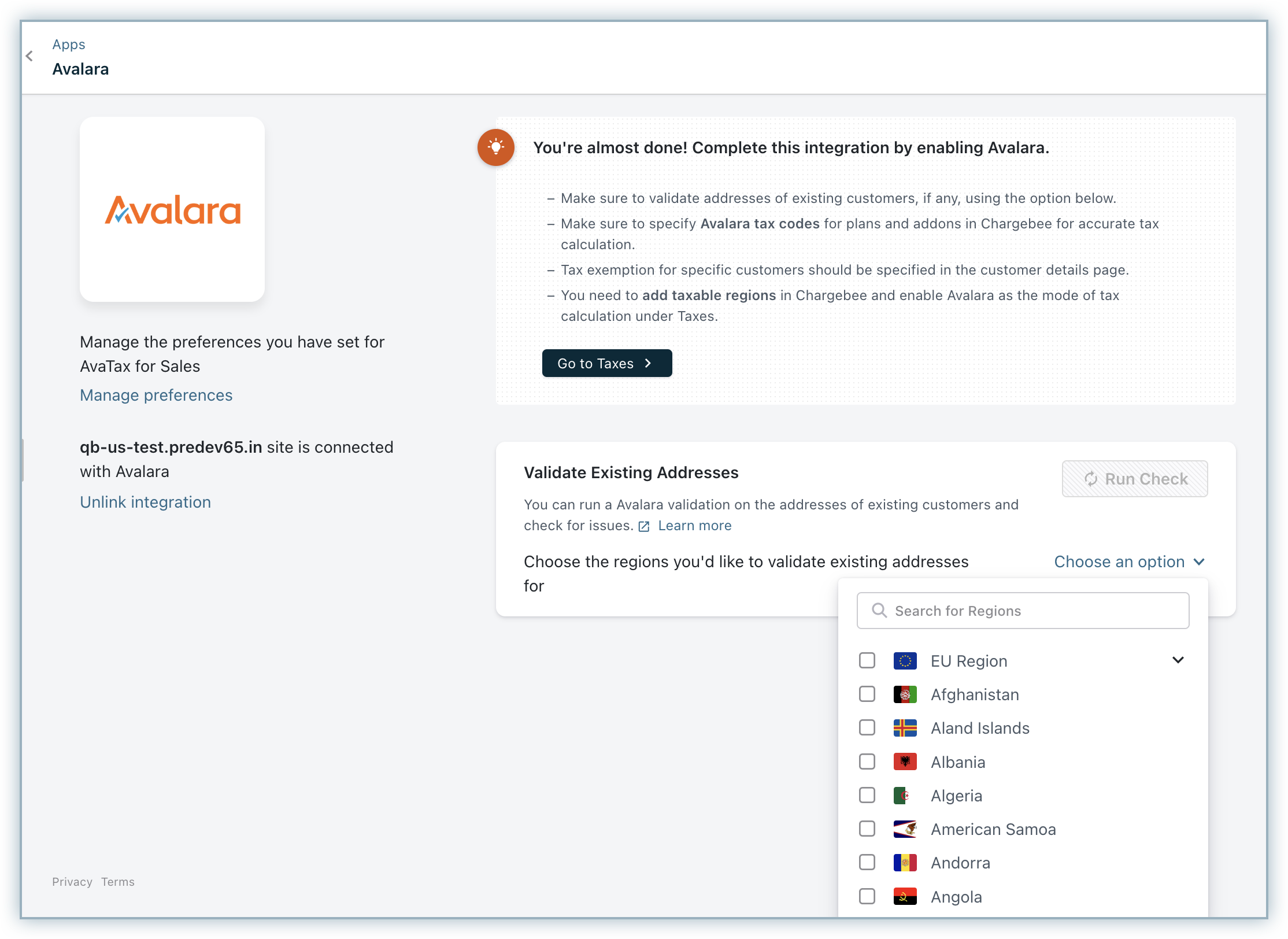

Avatax For Sales Chargebee Docs

Avatax For Sales Chargebee Docs

Woocommerce Avatax Woocommerce